Union County Commission lowers tax rate to 1.5899

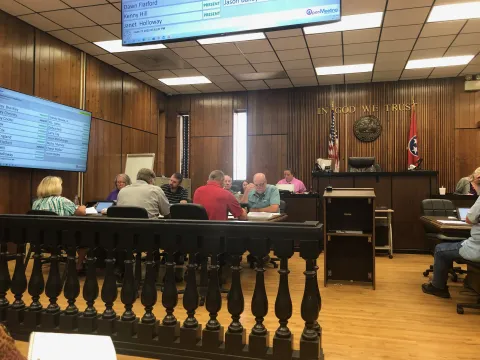

The Union County Commission took two meetings and over 20 votes before agreeing on a reduced tax rate of 1.5899. County Mayor Jason Bailey, partly recovered from a serious automobile accident in May, chaired the meeting. He urged and coaxed the commissioners to meet the July 1 deadline to submit the FY23 Budget to the state comptroller.

At the regular June 27 meeting Finance Director Missy Brown announced that the FY23 Budget was submitted and the deadline was met. However, because the approved rate is slightly above the state recommended rate and will bring some revenue above those of last year, the County Commission will hold a public hearing on July 7, 2022, at 7 p.m. in the big courtroom to hear any general public concerns. The public hearing is to explain the action of County Commission and hear comments, but it is not a meeting to figure an individual’s taxes or address individual increases or decreases in property taxes.

So how does the tax rate effect the amount of property tax paid last fiscal year and what may a property owner expect in the October 1 tax bill?

This reporter asked the Trustee's Office for some examples. If last year a property was valued at $100,000 the taxes were $535, that same property with no increase in value would have a tax bill this year of $397, a reduction over last year. If that $100,000 property was re-evaluated by the state at $150,000 this year, then the tax bill in October will be $596 or about $5 a month higher.

For a $200,000 property, last year's tax bill was $1070. If the value stayed the same, under the new tax rate the bill would be lowered to $795. If this same property increased in value to $250,000, this year's tax bill would be $994, which is still lower than last year.

The average selling price for a house in Union County in 2021 was $250,000. The taxes on a $250,000 property at last year's rate of 2.1399 was $1,337. The average selling price of a home today is $300,000 in Union County. The property tax at the new rate would be $1192.

During the state’s re-evaluation, the average increase in property value in Union County was 35 percent. Using this increase the $100,000 property would increase to $135,000, the $200,000 property to $270,000, and the $250,000 property to $337,500. The taxes under the new rate for the 35 percent increased value would be $539, $1073, and $1341 respectively or less than 50 cents a month. Of course, if the value of the property increased by more than 35% then the taxes for FY23 most likely will be higher than last year.

The County Commission at its regular meeting also increased the allotment to the volunteer fire departments of Luttrell, Sharps Chapel, Northeast Union, and the Rescue Squad to $25,000 and funded the increase from the general fund balance. Commissioners also increased the amount from the occupancy tax for the Union County Museum to $10,000 to help with building renovations and also increased the Union County Heritage Festival Grant to $7,500 from the same tax funds.

Commission will pay for the surveying of an acre of property on Hickory Valley Road that may soon be developed into a community center for Big Ridge if all of the requirements and the price can be worked out.

As the regular meeting closed, several commissioners commented that “we cannot continue to fund the budget out of the fund balance.” Next year’s budget will bring some challenges.

Except for the public hearing on July 7, there are no county meetings planned in July.

- Log in to post comments